November 2016 - Pony Express, Grinder skills, Ethiopia and Coffee Market news

Date Posted:6 November 2016

Pony Express - limited lots of extraordinary coffees

We are often asked to roast up exceptional coffees for special circumstances.

Sometimes, these are one-off situations and other times they might be infrequent, but ongoing arrangements. In almost all cases, the brief is abundantly clear - give me something that stands out from the crowd.

We have a special stash in the warehouse.... it contains impressive coffees - stuff that you can't source often enough for it to be offered as a regular portfolio product.

We can only buy it once a year and they are typically expensive coffees that our peers sell for around $50 - $60 per kilo in the retail market. In searching google, I found some of these coffees being sold for the equivalent of $75 per kilo, plus shipping.

I keep adding and subtracting from this stash every month.....often it's a fortnightly roasting for our prized subscription customers and other times it's for these "out of the box" type challenges we are thrown into at the deep end.

Roasting these coffees is exciting and fun - like driving a sports car on an open road.

We are opening up the gate on the Pony Express - a coffee experience to rival the best in Australia, available at affordable pricing.

The gate will be opened and closed at various times - it's not something that is always going to be available every day and sometimes the gate will be closed as we take our fresh roasted coffee commitment seriously. We will only roast these coffees when there is sufficient demand.

All of the coffees are sourced from the upper spectrum of the specialty coffee range, starting around 85+ points up to virtually 90 point coffees.

First up in November, we offer 6x lots in small quantities of 20kg each - available until sold out.

-

Kenya AA Ichuga (89 points) - intense dark cocoa

-

Kenya AA Kireimbe (90 points) - plum, chocolate, raisin

-

Costa Rica Vera Blanca (87 points) - intense sweet apricot

-

Tanzania Burka Estate AB (88 points) - perfectly balanced acidity, swiss chocolate

-

PNG Kuta Honey & Cherry (90 points) - tropical fruit, red berries, soaring candy sweetness

-

Ethiopia Sidamo Natural (86 points) - extremely fruity, aromatic, bold body, silky.

First in, best dressed.

The gate will close after these fresh roasted coffees are sold which we think will be quickly (we put the product up in the store this afternoon before releasing the Newsletter and already sold 12x units in the first hour).

All sold out sorry... but you can still buy coffee beans online

.jpg)

how well do you know your coffee grinder ?

Often overlooked as noisy, messy, and rather ugly appliance consuming critical bench space in a kitchen.

During the research and buying stage of sourcing coffee equipment, the grinder is generally relegated as a secondary consideration behind the importance of investing in an expensive, shiny espresso machine. However, the humble grinder does in fact play a more critical role in the overall brewing process and deserves equal attention and care.

There is one bet I will always punt on - that coffee enthusiasts eventually come to appreciate the grinder is EVERYTHING.

It takes a while for this realization to sink in and typically it's only after a few upgrades or extensive research involving sometimes exaggerated stories of stratospheric improvements read on an internet blog. Whilst it's tempting to be skeptical of such claims, the reality is that your coffee experiences and overall enjoyment will elevate to another level once you understand the dynamics of your grinder and manage it accordingly, or acquire a decent grinder that does the job of producing quality espresso grounds.

A wise saying has been circulated across the internet for more than a decade - you can match a quality grinder with an average machine, but you should NOT match an average grinder with a quality machine. In other words, invest more in a grinder than you had originally estimated. Many of the customers I speak to on a daily basis persist with sub-standard grinders, or are not aware of the impact of the grinder upon their beverage.

For espresso style brewing (or extraction) the grinder is perhaps the most critical element affecting the result in the cup - of course, technique has a large role to play in that statement.

We have prepared a detailed article on the various factors that affect the operation of the grinder. It's a long read, but we hope that you might glean something useful in helping improve your skills at using a coffee grinder.

Link to article is here - Improving your coffee enjoyment

Is Ethiopia at risk of losing it's Halo ?

This month we wanted to feature an Ethiopian coffee, actually we had planned to showcase a lovely new, fresh Sidamo lot but decided against it due to looming risk of shortages.

On October 9 2016, the Ethiopian Government announced a 6 month state-of-emergency across the nation. Our Australian media has been fixated on the US elections for months they failed to report or cover many important events from around the globe.

It follows a difficult year in violent protests and civil unrest against Government policies. A lot of people have been killed or detained and the recent directive has been legally challenged as violating many human rights privileges along with justifying the Ethiopian Government's further deployment of the army to enforce law. It is now deemed unsafe to travel within Ethiopia.

Ethiopia is the coffee universe's halo origin. Beyond being the world's 4th largest coffee producer (sometimes 5th if Sumatra has a good volume crop), it's the intensity, complexity and diversity of it's coffees that command such a mythical cult following.

Whilst it's early days and not much information is flowing out of the region (ironically, one of the recent directives), there are stories of coffee farms and plantations being abandoned at the most critical time of harvest and processing, a lack of labour to pick cherries and a raft of flow-on affects such as stranded logistics and potential freight embargoes looming.

Prior to the recent troubles in Ethiopia, it was already a very difficult origin to source coffee reliably. For many years I have been aware of challenges in accurately predicting when a shipment would depart Djibouti due to a constant state of gridlock from either poor productivity, red-tape or port congestion. It has not been uncommon for goods to sweat in containers for weeks awaiting the next available ship. Use of ports in neighbouring countries may be an option to keep import and export volumes flowing, however, this has been talked about for years and not much has changed.

Should the current issues develop into a broader problem with supply of Ethiopian coffees, we are bound to see a sharp increase in global coffee pricing as buyers look to alternatives out of Tanzania, Burundi, Rwanda and Kenya that will put a rocket under their crop prices. We are seeing some of this is showing up in new season offers for March 2017.

We have Ethiopian coffees in our warehouse and on forward contract, but certainly not enough as we would like to comfortably ride out the State of Emergency and the coming 12 months. Shortages will have an impact for every coffee company and will force a re-engineering of blends to compensate for what is typically a bean that is implemented to perform a critical highlight function.

At this time, our strategy is likely to be long on Sidamo, short on Yirgacheffe, Limu, and for Harrar we will look to temporarily de-stock when our existing holdings run down.

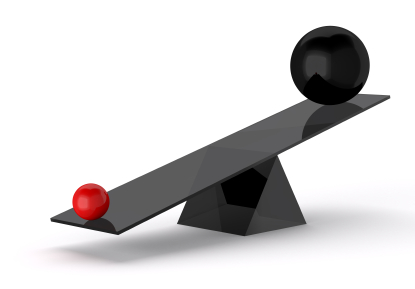

disequilibrium

Depending upon your personal interests, it's fair to say that one of the most fascinating spectacles across our nation over the last 4 years has been the unbelievable rise or fall of property prices in Australia. It seems that in Sydney and Melbourne stories emerge every week of suburban records being smashed or incredible premiums paid over the expected reserve prices and yet Perth is struggling with the end of the resources boom.

It's really difficult to get any context on what is fair or reasonable value when it comes to property pricing as the volatility and core fundamentals make no sense whatsoever. Even the experts are dumbfounded and grasping at straws with the Reserve Bank of Australia unable to lead the market direction with fiscal policy - the old strategies of interest rates are no longer valid.

I'm on the road early in the morning and what's become abundantly clear over the last 2 years has been the sheer volume of Builders and Tradie's on their way to site around metropolitan Melbourne. In fact, most of the traffic are Trades whereas not so long ago they were workers on the way to a factory. Whilst the factories seem to be closing as manufacturing shrinks in decline, yet construction trades are booming. Try and hire a tradie for a small or medium sized job and you wait months. It's also apparent in almost every street with multiple building works in progress - mostly knock-downs and multi-unit higher-density housing.

All of this reinforces the ways in which a market, all markets, function in cycles - influenced by the dynamics of supply and demand.

For as long as I can remember, people have been saying that coffee is the 2nd most traded commodity after crude oil. With such volumes of trade comes a high degree of price volatility and speculation. Weather patterns in key coffee growing regions like Brazil, Colombia and Central America can induce price spikes as futures traders drive the index up based on fears of a crop forecast shortfalls. At times I wonder if it's more about traders in New York making money from rise and falls in coffee futures than any real or possible outcomes.

The coffee market has many segments and without doubt the growth of specialty coffee and increased demand for higher quality grades see the pricing differential between a commodity grade and a top quality specialty grade vary by up to 400%. While commodity and commercial grade coffees are larger in terms of volume, it's the specialty segment that influences and shapes the dialogue of trade in the market.......a ripple in say Ethiopia, a key supplier of grades to the specialty segment generates waves across the entire coffee landscape.

The price gap continues to widen between commodity and specialty at astonishing rates. Whilst most people might think a standard and common business strategy involves always sourcing at lower costs, when it comes to the market of retail coffee, particularly Australia's intense competitive retail and beverage industry, the risks of sourcing cheap and mediocre ingredients are almost immediately apparent and can be value-destroying for a brand. In other words, taking a risk to buy cheap and mediocre coffee will ultimately lose customers - trading short-term commercial relief for a long-term damage to brand reputation and revenue.

Since the explosion of specialty coffee from around 2009, Australian coffee drinkers have developed a relatively fussy palate and expect, or quite rightly demand, only the absolute best when it comes to their daily fix. It's fair to say that for some time now many Australian coffee companies have been struggling to manage their strategic imperatives to source increasingly better qualities and grades that fit commercial outcomes. In simple terms, that means paying more for improvements in raw coffee grades that should, in theory, translate into a superior quality offering.

The customer and the competition drive the market, not the coffee companies.

If you don't constantly improve cup quality in line with the rest of the market, or keep striving to be ahead of the market, customers will simply switch to an easily sourced alternative. Retail coffee in Australia changed many years ago from a game of margin management to battle for customer acquisition and retention.

Which brings us back to the dynamics of coffee pricing. Raw coffee pricing changes on a daily basis, yet the retail price has historically remained relatively consistent. There are a few theories on why the retail price rarely changes and most of the thinking centres around the principles of saturated competition amongst suppliers and the buffering effects of inventories built up within supply chains. Some of this inventory buffering is artificial due to the span across multiple entities (roaster, importing broker, shipping, exporting broker, farm) and hence is a flawed assumption as to why retail prices of coffee rarely change in line with input costs.

The real reason for the relative harmony on retail coffee pricing is due to a distinct lack of courage on the supply side.......apparent fears of customer sensitivity to price volatility. Historically, it's a simple case of playing chicken or seeing who blinks first to raise prices. It's this fear of losing customers as a key barrier preventing the coffee market from operating as transparently as say bananas, avocados, wine, meat or other commodities that trade at the mercy of supply fluctuations.

In the last 4 months, the pricing for raw coffees has increased up to 25%. As an avid observer of market cycles over the last 10 years, we don't expect the coffee prices to retreat in the short term based upon the overwhelming growth in surging demand for quality grades and the outlook from forecast at origins. Consequently, we have adjusted our pricing approx. 5% which is below the industry average.